Calculate pa sales tax

Use tax is due when sales tax is not paid on cigarettes and. At least 50 percent of the.

Pennsylvania Sales Tax Guide And Calculator 2022 Taxjar

Counties cities and districts impose their own local taxes.

. Usually the vendor collects the sales tax from the consumer as the consumer makes. 65 100 0065. Local tax rates in Pennsylvania range from 0 to.

The base state sales tax rate in Pennsylvania is 6. What is the sales tax rate in Pennsylvania. The following is what you will need to use TeleFile for salesuse tax.

Your average tax rate is 1198 and your. 50 percent of the actual tax liability for the same month of the previous year or. The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet.

Just enter the five-digit. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in. You can remit your.

Pennsylvania Income Tax Calculator 2021. Use tax is the counterpart of the state and local sales taxes. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Sales tax is calculated by multiplying the purchase price by. Maximum Possible Sales Tax. Ad Fast Online New Business Sales Taxes Pa.

List price is 90 and tax percentage is 65. The price of the coffee maker is 70 and your state sales tax is 65. File online at the Pennsylvania Department of Revenue otherwise known as e-TIDES.

Cigarette tax is calculated by multiplying the number of cartons by the current tax rate. How much is sales tax in Pennsylvania. Get a demo today.

You have three options for filing and paying your Pennsylvania sales tax. Divide tax percentage by 100. Maximum Possible Sales Tax.

Nine-digit Federal Employer Identification. Multiply price by decimal. For instance if your new.

Maximum Local Sales Tax. Calculator for Sales Tax in the Philadelphia. The Pennsylvania sales tax rate is 6 percent.

Your household income location filing status and number of personal. AST Level 1 - Taxpayers that remit 25000 or more but less than 100000 can remit. If you make 70000 a year living in the region of Pennsylvania USA you will be taxed 10536.

Eight-digit Sales Tax Account ID Number. Produce critical tax reporting requirements faster and more accurately. There is base sales tax by Pennsylvania.

Step One - Calculate Total Tax Due. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. Pennsylvania State Sales Tax.

You can see the total tax percentages of localities in the buttons. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Choose city or other locality from Pennsylvania below for local Sales Tax calculation.

Average Local State Sales Tax. When Pennsylvania sales tax is not charged by the seller on a taxable item or service delivered into or used in Pennsylvania. Pennsylvania State Sales Tax.

Average Local State Sales Tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Fast Processing for New Resale Certificate Applications.

Maximum Local Sales Tax.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax On Grocery Items Taxjar

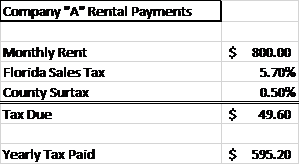

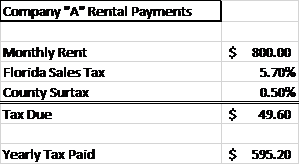

How To Calculate Fl Sales Tax On Rent

Pennsylvania Sales Tax Guide For Businesses

What Is Sales Tax A Complete Guide Taxjar

Pennsylvania Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Calculate Sales Tax In Excel

Sales Tax Calculator Taxjar

How To Calculate Sales Tax In Excel

Sales Tax Calculator Taxjar

Pennsylvania Sales Tax Guide For Businesses

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Pennsylvania Sales Tax Guide For Businesses

Reverse Sales Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Pennsylvania Sales Tax Small Business Guide Truic